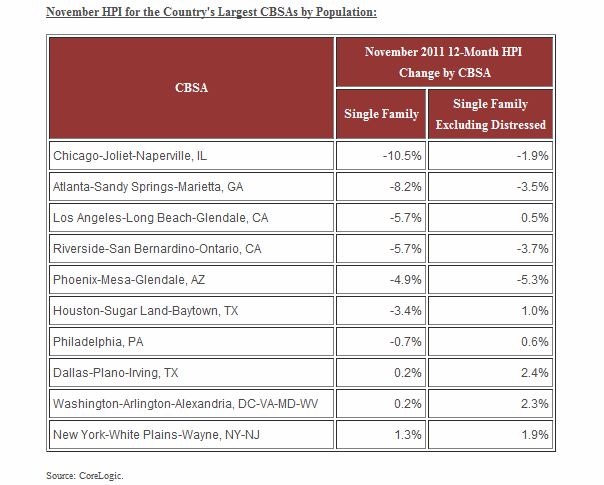

For the fourth consecutive month, U.S. home prices fell, according to CoreLogic, as distressed sales continue to plague the housing market. CoreLogic’s home price index fell 1.4 percent in November from October and slid 4.3 percent from November 2010, representing a larger annual slide than the month prior.

For the fourth consecutive month, U.S. home prices fell, according to CoreLogic, as distressed sales continue to plague the housing market. CoreLogic’s home price index fell 1.4 percent in November from October and slid 4.3 percent from November 2010, representing a larger annual slide than the month prior.

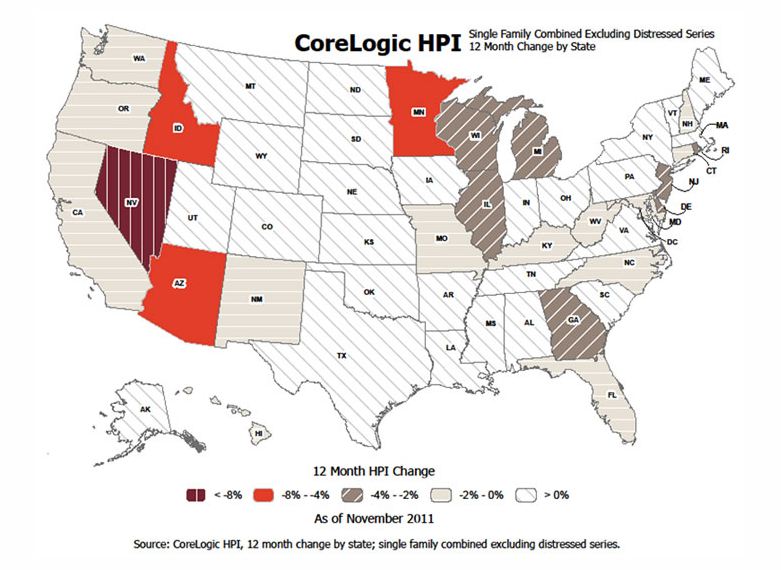

It is notable that when distressed sales are excluded from the data, prices only fell 0.6 percent year over year, given that distressed homes typically sell at a reduced price. “Distressed sales continue to put downward pressure on prices and is a factor that must be addressed in 2012 for a housing recovery to become a reality,” Dr. Mark Fleming, CoreLogic’s Chief Economist said in a statement.

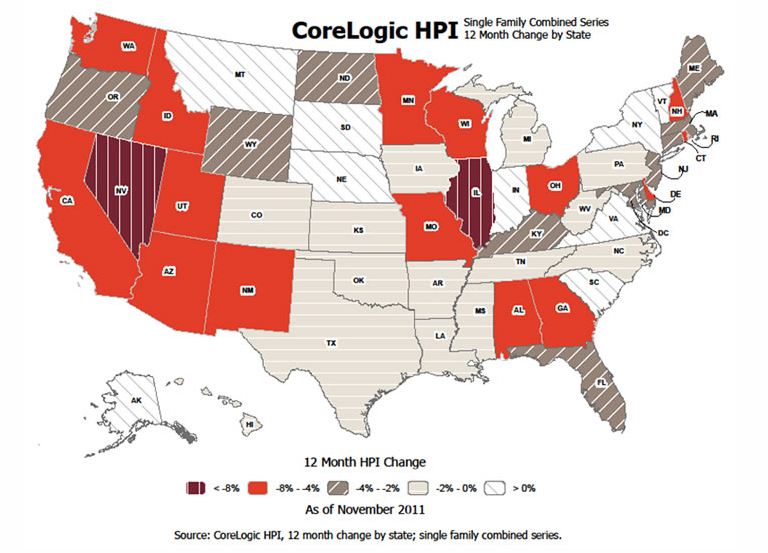

The five states with the highest appreciation in November are Vermont (+4.3 percent), South Carolina (+2.8 percent), District of Columbia (+2.1 percent), Nebraska (+1.9 percent) and New York (+1.7 percent). When distressed sales were excluded, the five states with the highest appreciation were: Maine (+4.9 percent), South Carolina (+4.9 percent), Montana (+3.8 percent), Indiana (+3.3 percent) and Louisiana (+2.4 percent).

The lowest appreciation rates were seen in Nevada (-11.2 percent), Illinois (-9.7 percent), Minnesota (-7.8 percent), Georgia (-7.7 percent) and Ohio (-7.2 percent). Excluding distressed sales, the five states with the greatest depreciation were Nevada (-8.8 percent), Arizona (-4.9 percent), Minnesota (-4.7 percent), Idaho (-4.1 percent) and Georgia (-3.6 percent).

Fully 77 percent of all areas studied by CoreLogic experienced annual declines for the month, three less than in October.