Existing Home Sales Report From NAR [INFOGRAPHIC]

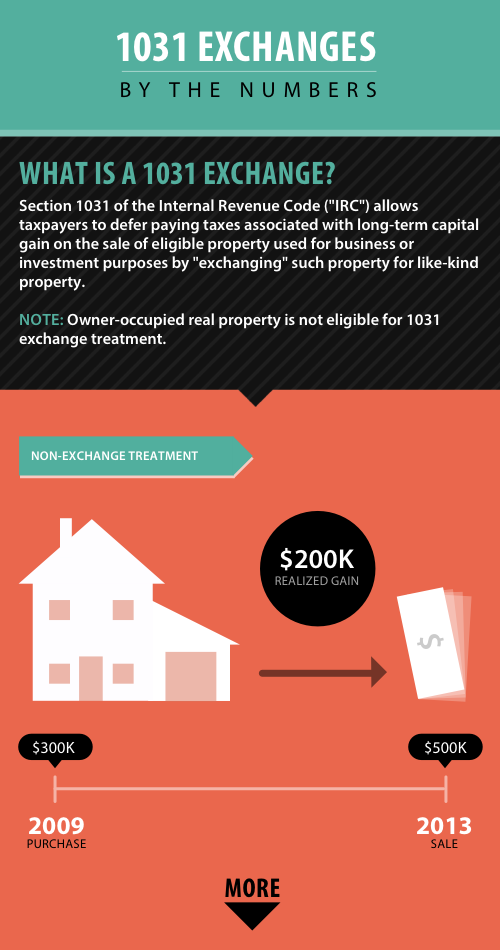

Defer Capital Gains On Investment Properties: 1031 Exchanges By The Numbers

1031 Exchanges by Cook & Cook

How Does My Home Rate As An Investment

Money.cnn.com put out a cool calculator that shows how your your home’s rate of return compares to a variety of investment instruments. Choose dates and use the sliders to show your return.

Buying A Home, See What’s Right For You

Our Changing Housing Market

The housing market has changed a lot over the last 40 years, with the number of home sales, the size of homes, and the cost of homes all changing since the 1970s. Check out this great infographic below to see the ups, and downs, of the housing market over the last 40 years.

source: MitchellHomesInc.com

source: MitchellHomesInc.com

Survey: Buyers Will Pay More for Good Schools

More than 44 percent of home buyers who plan to buy a home within the next two years said they would be willing to go over their budget by up to 10 percent in order to buy in their preferred school boundaries, according to a new survey by realtor.com®.

More than 44 percent of home buyers who plan to buy a home within the next two years said they would be willing to go over their budget by up to 10 percent in order to buy in their preferred school boundaries, according to a new survey by realtor.com®.

Three out of five home buyers surveyed said that school boundaries greatly impact their home purchasing decision. Nearly 9 percent of buyers indicated that they’d be willing to pay 11 to 20 percent above their budget to get a home in a desirable school district, the survey found. About 17 percent of buyers said they want to live within a mile of a school so their children can walk there.

Some home buyers said they’d even be willing to trade certain home amenities for good schools: About 62 percent said they’d give up a pool or spa, 50 percent would give up accessibility to shopping, and nearly 44 percent would pass on a bonus room.

“Our survey demonstrates the large impact school boundaries have on those looking to purchase a home,” says Barbara O’Connor, chief marketing officer at Move Inc.

The survey comes after realtor.com® launched a new mobile school search tool in April, allowing buyers to search for listings in specific school and district boundaries.

Source: realtor.com®

Homeowners Association: What You Should Know

With many neighborhoods associated with a homeowners association, chances are that you may live in one.

With many neighborhoods associated with a homeowners association, chances are that you may live in one.

When you move into a neighborhood with an association, you are agreeing to abide by certain rules, and you acknowledge that rule breakers may face financial consequences. Understanding the association’s rules and your rights and responsibilities as a homeowner will facilitate harmonious living.

Whether you call it a homeowners association, a community association, or a common interest community, these names can confuse new homeowners, but the concept of all three entities is similar:

- The association is a legal entity registered with the state of Nevada and was created at the onset of your neighborhood’s construction.

- Its responsibility is to maintain your neighborhood’s common areas.

- It has the right to enforce deed restrictions on your home.

In Washington, associations have been established in newer neighborhoods and condominium and townhome developments. Your home may have more than one homeowners association if it’s located in a planned community.

Understand the Rule Book

Your association’s rules are found in the “Covenants, Conditions and Restrictions” (CC&Rs) and other governing documents. Per the law, the seller or builder provides you with these documents at the time of purchase, and they become part of your home’s title.

CC&Rs describe a variety of items, such as how residents are elected to your association board, meeting rules, dues, home maintenance requirements, pre-approvals for changes to your property, restrictions on your home’s use, and fines. They also describe the association’s responsibilities for the maintenance of common areas, like parks, pools, a gated entrance, or landscaping.

The rules can vary greatly by association. Some communities are age restricted and require residents to be of a minimum age. Others may designate a specific area for adults only, while others may provide a pre-approved desert paint palette that will prevent you from painting your craftsman-style home in neon polka dots. Some rules will prevent you from turning your home into a rental or will limit the number or size of pets. Fines of different amounts may be levied on those who do not follow the rules.

- Because the rules can vary, it is essential to read and understand all CC&Rs before you buy your home.

- If you do not agree with them, it is simple — do not buy in that neighborhood.

When Problems Arise

Problems can arise even when you understand the rules. Perhaps a neighbor files a complaint or you are notified of a possible violation. CC&Rs list the protocol for conflict resolution: who to contact and how to appeal a violation or fine.

Like policy-based governance, a homeowners association only has the rights that are set forth in its CC&Rs. They cannot make up new rules. If this kind of management concerns you, you may want to consider buying a single-family home where there are fewer, less stringent or no restrictions at all.