What You Need to Know About Qualifying for a Mortgage

Gallup: Real Estate is Best Long-Term Investment

Every year, Gallup surveys Americans to determine their choice for the best long-term investment. Respondents are given a choice between real estate, stocks/mutual funds, gold, savings accounts/CDs, or bonds.

For the fourth year in a row, Real Estate has come out on top as the best long-term investment! This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26%. The full results are shown in the chart below.

The study makes it a point to draw attention to the contrast of the sentiment over the last four years compared to that of 2011-2012, when gold took the top slot with 34% of the votes. Real estate and stocks took second and third place, respectively, while still in recovery from the Great Recession.

Bottom Line

As the real estate market has recovered, so has the belief of the American people in the stability of housing as a long-term investment.

Do You Know the Cost of Waiting?

- The “Cost of Waiting to Buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

- Freddie Mac predicts that interest rates will increase to 4.8% by this time next year, while home prices are predicted to appreciate by 4.9% according to CoreLogic.

- Waiting until next year to buy could cost you thousands of dollars a year for the life of your mortgage.

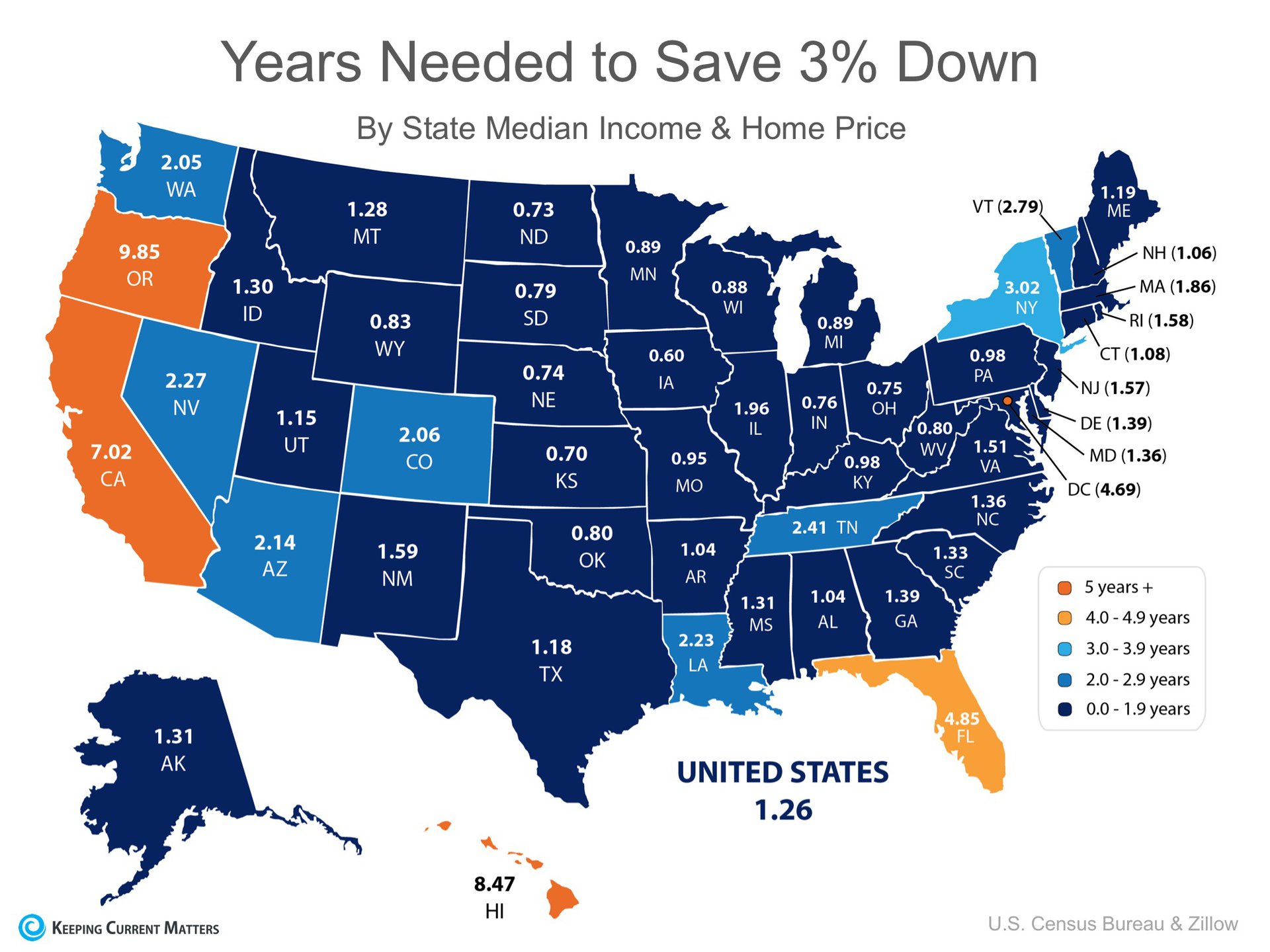

How Fast Can You Save for a Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for a down payment in each state? Using data from the United States Census Bureau and Zillow , we determined how long it would take, nationwide, for a first-time buyer to

Millennials Want To Buy Homes

The Real Cost of Renting vs. Buying [INFOGRAPHIC]

- Historically, the choice between renting or buying a home has been a close decision.

- Looking at the percentage of income needed to rent a median-priced home today (30%), vs. the percentage needed to buy a median-priced home (15%), the choice becomes obvious.

- Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home of your own!