Should You Send That Email?

Canadian VS. American Homeowners

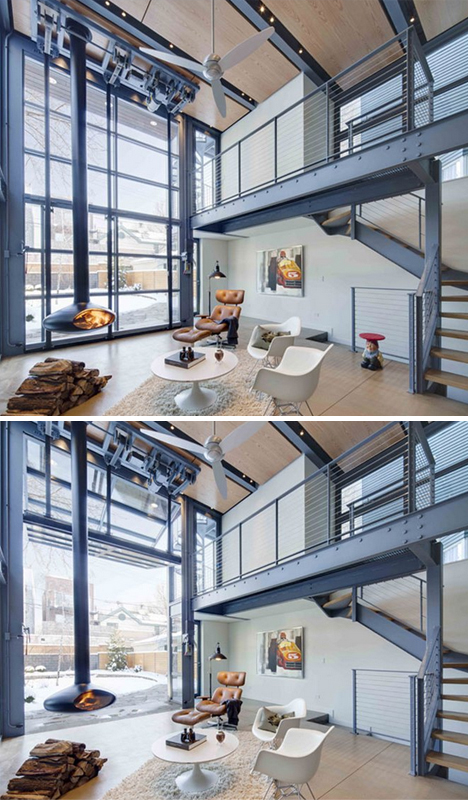

18-Foot Glass Hangar Door Opens Stunning Steel Addition

This home extension is all about the outdoors, from bringing natural light and ventilation to the interior to pushing its occupants out into a big backyard or up onto a stunning rooftop deck.

From their time in England, the owners wanted the familiar feel of an open conservatory in their Chicago home addition – and got their wish in spades from dSpace Studio.

In front, the original 1880s Italianate facade can be found intact, sharply solid against thin steel and light planes of glass behind.

Meanwhile, the operable six-meter, garage-like door makes an open-feeling space actually open up out into the yard on demand as well.

Sustainable design elements include recycled materials, energy efficient LED lighting, rainwater collection system, drought-tolerant plantings, high-efficiency mechanicals, solar hot water system, radiant floor heating, and infrastructure for future geothermal installation.

Measuring the U.S. Melting Pot

More than half of the nation’s 3,143 counties contain a plurality of people who describe themselves as German-American, according to a Bloomberg compilation of data from the Census Bureau’s 2010 American Community Survey.

Click on the graphic to explore the results of the survey and see the distribution of other heritages across the country. Select an ancestry from the menu on the left to see its concentration, county by county, then choose one from the right to compare their relative prominence in a region.

Can You Believe This Is A Prefab Home?

In the last three articles of our Green Guide to Prefab series we discussed the history of prefab design, the evolution of mobile homes into modular prefabricated homes, and ways to maximize eco-efficiency when choosing a site for your prefab. Despite certain components being prefabricated off-site, prefab homes actually offer a lot in the way of customization, allowing individuals to customize many features to create the perfect living environment for the lifestyle of the owner. In the latest article in our Green Guide to Prefab series, we’ll be taking a closer look at the idea of an owner’s lifestyle, and we’ll tell you the questions you need to ask in order to build a home that fits with your life. Read ahead as former Lindal Cedar Homes CEO and green design consultant Michael Harris returns to Inhabitat to walk us through the business of examining lifestyle and understanding why this element is crucial in creating a happy, comfortable and enduring home.

In the last three articles of our Green Guide to Prefab series we discussed the history of prefab design, the evolution of mobile homes into modular prefabricated homes, and ways to maximize eco-efficiency when choosing a site for your prefab. Despite certain components being prefabricated off-site, prefab homes actually offer a lot in the way of customization, allowing individuals to customize many features to create the perfect living environment for the lifestyle of the owner. In the latest article in our Green Guide to Prefab series, we’ll be taking a closer look at the idea of an owner’s lifestyle, and we’ll tell you the questions you need to ask in order to build a home that fits with your life. Read ahead as former Lindal Cedar Homes CEO and green design consultant Michael Harris returns to Inhabitat to walk us through the business of examining lifestyle and understanding why this element is crucial in creating a happy, comfortable and enduring home.

HOW YOUR LIFESTYLE AFFECTS THE PLANNING PROCESS

For many people, building a home is an exciting prospect that draws upon long-time dreams of creating a living environment that reflects their sensibilities, individuality and independence. Those who opt for prefabricated housing over moving into new communities of cookie-cutter tract houses are typically stirred most by those values — and this is what makes them as unique as the houses they seek.

Some of you are looking forward to planning your new home from scratch and are excited by the opportunity to proceed at a leisurely pace as you plan every detail with an architect. Others of you have may have already designed your dream home on paper and are seeking an expert such as an engineer to help you refine your creation and bring it to code. But there several of you who aren’t working from scratch, but are instead seeking out an existing design that will serve as a good starting point to developing your home. Prefab design is an attractive option for those in search of a perfect lifestyle fit without investing all the time, anxiety and headache that comes with building something from scratch.

One of the most important first steps to building a new home is to decide which of the above approaches best describes your planning temperament. Once you’ve done that, you need to explore this with prefab home builders. By visiting several builders you’re more likely to find one who can provide you with the type of planning experience that suits your lifestyle and temperament. It is important to ask a lot of questions to determine who is your best fit — your choice will bring you closer to making your dream home a reality.

How Scary Is The Shadow Inventory?

According to NAR (National Association of Realtors) research, the amount of “shadow inventory”, in other words, what the banks will be releasing into the marketplace, will be a 4 month supply in Washington State, the lowest in the country. Presently, we are in need of inventory in King County. Once these homes are released, the consensus is that they will be absorbed rather quickly.

What You Need to Know about Cancellation of Mortgage Debt

This column is brought to you by the NAR Real Estate Services group.

This column is brought to you by the NAR Real Estate Services group.

A lender will, on occasion, forgive some portion of a borrower’s debt. The general tax rule that applies to any debt forgiveness is that the amount forgiven is treated as taxable income to the borrower. Some exceptions to this rule are available, but, until recently, the borrower was required to pay tax on the debt forgiven. A new law enacted in December 2007 provides relief to troubled borrowers when some portion of mortgage debt is forgiven. However, this relief expires on December 31, 2012 and NAR will be working to obtain an extension throughout the year.

Below is some general information you need to know about this law and cancellation of mortgage debt.

General Rule for Debt Forgiveness

If a lender forgives some or all of an individual’s debts, the general rule is that the forgiven amount is treated as ordinary income and the borrower must pay tax on the forgiven amount. Exceptions apply for bankruptcy, insolvency and certain other situations, including mortgage debt.

Current Law for Mortgage Debt

(Jan. 1, 2007 through Dec. 31, 2012): A borrower can be excused from paying tax on forgiven mortgage debt. The debt must be secured by a principal residence and the total amount of the outstanding obligation may not exceed the original mortgage amount plus the cost of any improvements.

Does the relief apply only to a sale?

No. The provision has broader application. Lenders might forgive some portion of mortgage debt in a short sale (when value at sale is less than the amount owed) or in a foreclosure where the debt is wiped out. In addition, if a borrower still living in the home is able to make an arrangement with a lender that reduces the principal balance of a mortgage, the amount forgiven in that workout will not be taxed.

Can the homeowners in a short sale or foreclosure claim a loss?

No. The loss is considered a personal loss and is, therefore, ineligible for either capital loss or ordinary loss treatment.

What happens to the seller when mortgage debt is forgiven?

Until January 1, 2013, the homeowner will pay no tax on any forgiven amount.

Does this provision apply to a refinanced mortgage?

Only in limited circumstances. The relief provision can apply to either an original or a refinanced mortgage. If the mortgage has been refinanced at any time, the relief is available only up to the amount of the original debt (plus the cost of any improvements). Tax relief is generally not available for second mortgages or home-equity lines of credit where the funds are not used for home improvement. Any amount that is not eligible for the relief provision will be taxed as ordinary income.

How does the homeowner get the correct information to the IRS?

The lender is required to provide the homeowner and the IRS with a Form 1099 reflecting the amount of the forgiven debt. The borrower/homeowner must file a Form 982 to reflect the amount forgiven and to show the reason why the forgiven amount is not taxable. Any taxable portion of forgiven debt will then be reported on the homeowner’s Form 1040 for the tax year in which the debt was forgiven.

What if a property declines in value but the owner stays in the house?

The provision would not apply. The provision applies only at the time of sale or other disposition or when there is a workout (reduction of existing debt) with the lender.

Do all lenders forgive mortgage debt when property values decline or the home is in foreclosure?

No. Some states have laws that allow a lender to require a repayment arrangement, particularly if the borrower has other assets. Forgiveness of debt is always at the lender’s discretion.

Linda Goold is the Tax Counsel for National Association of REALTORS®.