click image for larger view

The History Of HiFi

How to Fix a Door That Sticks

By: REBECCA ZACKS, This Old House magazine

The personality of an old door changes with the seasons. Pulled tight in winter, it’s a stalwart guardian against chills and drafts. But by August, heat has driven moisture deep into the grain, and the once-yielding door has become swollen and stuck.

The personality of an old door changes with the seasons. Pulled tight in winter, it’s a stalwart guardian against chills and drafts. But by August, heat has driven moisture deep into the grain, and the once-yielding door has become swollen and stuck.

This Old House general contractor Tom Silva confronts a stubborn summertime door with a jack plane and a little restraint. “You want to take off the minimum amount of wood necessary because the door is going to shrink again in the winter,” says Tom. “If you remove too much, it will sit loose in the opening.” Follow along as Tom fixes a swelled door in his own home with just a few simple tools.

Read the rest here.

A Whole Room Hidden in One Box

How to furnish a room with just a box? Here is an idea by German designers Marcel Krings and Sebastian Mühlhäuser.

How to Upgrade Your Home on a Budget

By: JILL CONNORS, This Old House magazine

Photo: Mark Lohman

Beautiful Bungalow

It takes a certain eye to see a smart little cottage where others see a stucco teardown. But Steve and Shauna Mullins had exactly that vision when they first saw this 875-square-foot bungalow in Hermosa Beach, California.

“It was in a great location, less than a mile from the beach, and the basic layout was good—it hadn’t been screwed up,” Steve says. Still, the exterior of the 1941 house was showing its age, and its small rooms needed an update. Collaborating with architectural designer Rosa Velazquez on the front of the house, doing much of the work themselves, and enlisting a general contractor for the bigger projects, the couple lavished the tiny two-bedroom with a proud new facade and freshened the interior throughout.

For nearly all their redo needs, they jumped in the car and hit nearby home centers, scouring the aisles for well-priced shutters, fencing, cabinets, crown molding, paint, and more. Keep reading for the redo rules they followed—what worked for them can work for you, too.

Read the rest here.

The Most Beautiful Skylines Around the World

New York City, United States

San Diego

Chicago

Seattle, Washington

Philadelphia

Melbourne, Australia

Sydney

Brisbane

Paris, France

Damascus, Syria

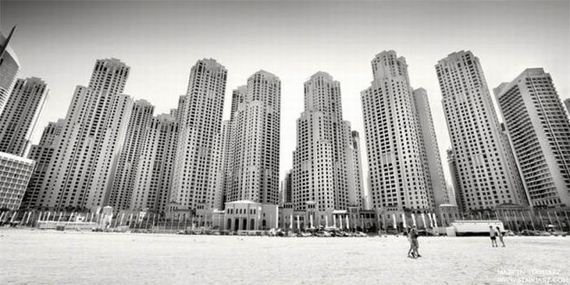

Dubai, United Arab Emirates

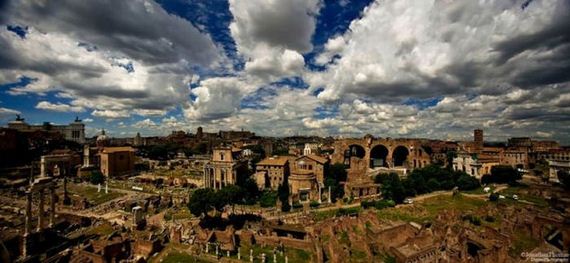

Rome, Italy

Moscow, Russia

Tokyo, Japan

Frankfurt, Germany

Sibiu, Romania

Malaga, Spain

Singapore, Marina Square

Bangkok, Thailand

Lviv, Ukraine

Kuala Lumpur, Malaysia

Sao Paulo, Brazil

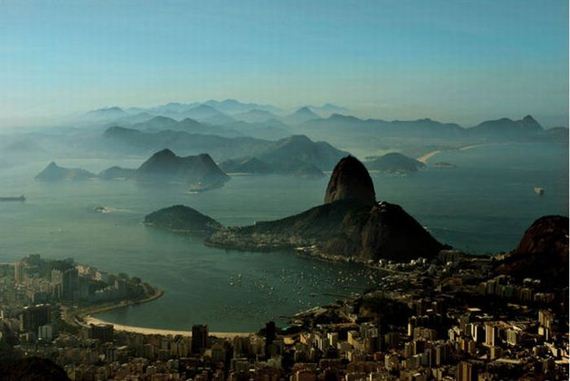

Rio de Janeiro

Vancouver, Canada

London, England

Jakarta, Indonesia

Buenos Aires, Argentina

How to Rebuild Your Credit After a Foreclosure or Short Sale

If you’re one of the millions of Americans who experienced either a foreclosure or short sales due the housing downturn, you might be left wondering where to go from here, when it comes to rebuilding your credit score.

If you’re one of the millions of Americans who experienced either a foreclosure or short sales due the housing downturn, you might be left wondering where to go from here, when it comes to rebuilding your credit score.

Here is the information you must know about your credit, to best recover from a foreclosure or short sale.

Know How Things Ended

Though you may be relieved to have finally resolved your housing situation, don’t put it out of your mind just yet. Keith Gumbinger, mortgage expert forHSH.com says that knowing the final terms of the arrangement made with your lender plays a role in rebuilding credit. That’s because different defaulted home loan terms come with different ramifications to your credit score. Know whether you had a short sale (the lender allows you to sell the house for less than the balance on the mortgage, and may or may not require you to make up the deficiency), an involuntary foreclosure (you stopped making payments and the property, and potentially your assets, were seized), or you negotiated a deed-in-lieu of foreclosure (a voluntary process in which you “hand over” the deed to the lender, shortening the process and accompanying expenses), as well as the specific terms were agreed upon. When it comes to foreclosures and short sales, no two agreements are alike; the terms and conditions have different impacts on credit scores, how they are reported to the credit bureaus, and how long they take to “fall off.”

Confirm Where You Are Now

While short sales are often perceived as more “favorable” when it comes to defaulting on a home loan, FICO conducted a study simulating the aftermath of a foreclosure and a short sale, and revealed that in regards to credit score impact, there isn’t much difference between the two events. The real gauge, it seems, is in the starting credit score before the default took place.

FICO examined three hypothetical consumers with starting credit scores of 680 (customer A) 720 (customer B), and 780 (customer C). It found that despite whether the loan default was a short sale or foreclosure, customer C’s credit score was most impacted, indicating that the higher the credit score, the longer it takes to restore. Further, time is critical in rebuilding credit worthiness: a short sale with no deficiency balance will generally require at least three years before the credit score will increase. In the case of a foreclosure, the borrower must wait for at least seven years, and in some cases, up to ten, if a bankruptcy filing was involved.

Keep Credit Cards Under Control

After you have completed the foreclosure or short sale, request your credit report fromAnnualcreditreport.com, which allows you one free credit report each year. Confirm that the report does not contain any errors, or reflect old debts that were paid off, and report any disputes to Experian, TransUnion and Equifax immediately. Ornella Grosz, author of Moneylicious: A Financial Clue For Generation Y says that one way to add points to your credit score is by paying off or lowering your existing credit card balances, and that “about 30 percent of your credit score is made up from keeping balances low. The lower your debt-to-income ratio, the better.” John Ulzheimer, Mint’s credit columnist, also addresses this the post What Kind of Debt Pay-Off Boosts Your Fico Score Most.

Set up automatic bill pay on all of your existing credit accounts to make certain that creditors are always paid on or before the due date (don’t play with grace periods when you’re trying to rebuild credit). Or use the “Bill Reminders” feature on your Mint.com account. If you have missed payments in the past, commit to starting good habits now. You can rebuild a score by paying every bill on time. On the contrary, skipped or late payments will reduce your credit score further. Don’t attempt to raise your credit score by closing open credit lines, and know that removing the credit availability might actually hurt your score more after a short-sale or foreclosure, when access to new credit will be limited. (To potential lenders, closing the credit, even it you haven’t used it in years, makes it appear as though you are closer to being “maxed out” than you really are).

If you are left with no credit lines after the foreclosure or short sale and cannot find unsecured lines of credit, apply for a secured credit card, which are offered by many financial institutions and credit unions. Secured cards will require you to deposit funds with the creditor, in exchange for a credit card with a credit line of the same amount. (For example, if you put $500 down, that will be the amount of your secured credit line). If you use secured cards responsibly, they will help to slowly increase your credit score. Over time, the lender may raise your line of credit for “good behavior,” and eventually, you’ll be a candidate for unsecured credit again. However, Grosz cautions to read the fine print in the agreement for all secured cards, and confirm that you will not be charged additional fees for use.

Be Patient

Rebuilding credit after a short sale or foreclosure can be frustrating, but it is a process most impacted by being patient. Amber Stubbs, senior managing editor at Cardratings.com says “the more time passes, the less a black mark affects your credit, and you won’t be able to make a full recovery until the derogatory item is off your credit report. Most derogatory items, including foreclosures, fall off seven years after the last activity on the account. If you manage other accounts responsibly while you wait, you should be in good shape by the time the foreclosure disappears from your credit report.”

Stephanie Taylor Christensen is a former financial services marketer based in Columbus, OH. The founder of Wellness On Less, she also writes on small business, consumer interest, wellness, career and personal finance topics.

Tennessee Musician Creates 27-String Guitar

Keith Medley has been a master guitar builder for most of his adult life, and while he has created custom instruments for many famous musicians, his most impressive guitar is the one he made for himself.

If you’re missing a guitarist or two for your band, stop worrying, because the 27-string guitar Keith Medley invented has the power to make them obsolete. The only trick is learning how to play it. That’s in fact the biggest problem, White House-based Medley had to overcome, as well. “Building this guitar turned out to be the easy part,” Keith explains on his site. “The hard part has been learning to play it. Through two years of bittersweet struggle between myself and these 27 strings, I determined it would not defeat me but would play the music I heard in my heart.”

But why would anyone need a 27-string guitar, when most guitarist seem to do very well with just 12, or even 6? Keith says the music he hears in his head is more than can be played on six strings, so after many sketches and nights of contemplation, he came up with this unique 27-string instrument. He claims it’s like playing three instruments at the same time, but that apparently isn’t good enough since he’s now working on a guitar with 34 strings.

27 strings sounds impressive, 34, even more so, but believe it or not, Keith Medley hasn’t created the guitar with the most number of strings. In 1984, Linda Manzer and Pat Metheny designed and created a 42-string guitar called the Pikasso. You can see it in action in the last video, at the bottom.

Pat Metheny Pikasso 42-string guitar

DOG HOMES | BY BEST FRIEND´S HOME

How cool are these dog mansions, they are produced by German company “Best Friends Home“. The quality and richness of detail is quite amazing. There are four models to choose from, but the houses can also be customized, by sending a project to be followed. Perhaps a replica of the owner´s house.