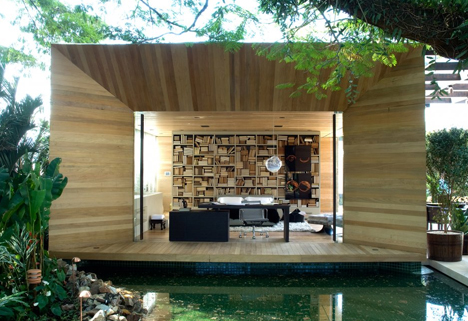

Outside and inside slide seamlessly together in this lovely little loft built of thick wooden beams, textured limestone floors and rough stone walls, all tied together by thin and unobtrusive steel members and spanned, when necessary, with crystal clear glass.

Designer Fernanda Marques’ core idea involved tying together a classic country villa with the rigorous Modernism of masters like Mies van der Rohe, weaving a series of boxy rectangular forms into their environment on the outskirts of Sao Paulo, Brazil.

Wooden browns are a recurring theme, from wall-wide bookcases to smaller shelves, side tables, sofas, sheets, Â blankets and cushions, both within and without the thick-walled central library space.

A heavy stone table, built-in niches, cabinets and bookcases also blur the boundary between furniture and architecture, projecting into and out of walls and adding a rich layer of variegated materials to the already-organic interior design.

Insulating your home, including the attic, can shave up to 10% off your energy bills. Image: CertainTeed

Insulating your home, including the attic, can shave up to 10% off your energy bills. Image: CertainTeed

Baby boomers are used to shaking things up. Due to their large numbers and political activism, boomers have transformed America at every stage of their lives.

Baby boomers are used to shaking things up. Due to their large numbers and political activism, boomers have transformed America at every stage of their lives.

Use the right tools. Picture hanging kits, easily available at most hardware and department stores, often have all the materials you need to hang most common frames on your walls. Light pieces like photos, movie posters, and other art will likely require just a nail, or a nail and a bracket or picture hanger (most light frames have a bracket on the back already.) Photo by

Use the right tools. Picture hanging kits, easily available at most hardware and department stores, often have all the materials you need to hang most common frames on your walls. Light pieces like photos, movie posters, and other art will likely require just a nail, or a nail and a bracket or picture hanger (most light frames have a bracket on the back already.) Photo by