Stairs don’t have to be a completely utilitarian installation. Sometimes, stairs can lead absolutely nowhere at all such as this sculptural staircase featured in the first picture. These stairs are definitely for a journey, not a destination. Other stairs are far more impressive to the eye than they would be practical and useful staircases. Some are so twisted and turning that a couple of imbibed wobbly pops would make them a real challenge!! The piano staircase shows that stairs can serve more than one purpose — adding a bit of music to one’s daily trek to public transportation can certainly liven things up a bit! However, my favorite, by far is the last picture with two options downwards — by stair or by slide. Most kids would kill for this staircase to the kitchen for their morning cereal.

Rising Rents Improve Investors’ Returns

With rents rising faster than last year, the picture for residential real estate investors is getting even better than it already was as a result of once-in-a-generation prices and low interest rates, according to the founder of a leading Internet platform for investors and real estate professionals.

With rents rising faster than last year, the picture for residential real estate investors is getting even better than it already was as a result of once-in-a-generation prices and low interest rates, according to the founder of a leading Internet platform for investors and real estate professionals.

Greg Rand, CEO of OwnAmerica, downplays concerns over near term price declines and urges investors to take a long view of the opportunities.

“This is a long term investment,” says Rand, who differs with what he calls the “get rich quick” approach to investing. “Rents are a steady return on your investment through the years, leaving you with an attractive asset when prices improve. And they will. The best profits in real estate accrue to long term investors who take a long term view.”

Rents are growing at a 5.17 percent annualized rate compared to a 4.72 percent at this time last year Assuming effective rent grows at the same rate in the next four months as it did in 2010, the full-year total would fall just below the historic highs of 2000 (6.18 percent) and 2005 (5.81 percent), according to a report from Axiometrics Inc., a provider of data and analysis on the apartment market.

With 1.4 million new renters this year, apartment construction can’t keep up with demand. Tenants, especially former homeowners forced from their homes because of the economy, are increasingly turning to single family homes owned by investors, especially in high foreclosure markets like Las Vegas.

During this year, investors have accounted for between 20 and 40 percent of monthly existing home sales, according to surveys of Realtors by Campbell/Inside Mortgage Finance and the National Association of Realtors. Yet, the investor market share may increase even more next year.

A survey by Realtor.com in April found that by a three to one margin, investors plan to be more active in their local markets compared to typical homebuyers in the next 24 months, and 69 percent of investors say it’ll be easier to find properties in the near future.

Most investors are newcomers. Fifty-nine percent (59%) said they’re new to real estate investing, with 33.5 percent considering their first investment purchase and 8.5 percent in the process of buying and selling their first investment property. Another 17 percent said they just completed their first transaction and plan to make more. Only 36.5 percent have experience in more than one property transaction.

Author of “Crash! Boom,” Rand argues that even in the Great Depression, owning real estate was always better than not owning real estate. Holding real estate for the long term has always been a formula for success and most family wealth has been accumulated by purchasing real estate and keeping it in the family for many generations. Real estate plus time usually equals success.

There are 6 million people who went from being owners to being renters, Rand says. “The stars are aligned to make this the best time in modern history to be a landlord,” he wrote in his book.

If you are interested in exploring investment opportunities, call me @ 206-713-3244 or email Emmanuel@EmmanuelFonte.com

Senate backs plan to help Americans buy homes

WASHINGTON — The Senate on Thursday backed a measure to help bolster the housing market by making it easier for people to afford a home in wealthier neighborhoods.

WASHINGTON — The Senate on Thursday backed a measure to help bolster the housing market by making it easier for people to afford a home in wealthier neighborhoods.

The Senate voted 60-38 to attach the proposal to a spending bill that the chamber will consider later this year. It would restore the size of the loans the government buys or insures to a maximum of $729,500 from the previous cap of $625,500.

The cap, known as the "conforming loan limit," determines the maximum size of loans the Federal Housing Administration and the government’s mortgage buyers, Fannie Mae and Freddie Mac, can buy or guarantee.

The higher loan limit expired at the end of September and was touted as one of the Obama administration’s short-term plans to shrink the government’s role in the mortgage market.

But with the housing sector hurting the country’s economic recovery, lawmakers and the administration are looking for solutions.

"Getting our housing market moving again is one of the most important tasks facing the country," said Robert Menendez, a Democrat from New Jersey who introduced the bill amendment.

The majority of Senators agreed that the lower loan limit was making a weak housing market even weaker. "It makes it harder for middle class homebuyers to get credit when credit is tight," Menendez said.

It is unclear what will ultimately happen to the provision, given the deep divisions within the Democratic-led Senate and Republican-controlled House of Representatives. It would have to pass both chambers before President Barack Obama, a Democrat, could sign it into law.

Republican Senator Richard Shelby said the measure would help homebuyers who "do not need federal subsidies." "This is not a good use of taxpayer dollars," he said.

Republicans in the House have been trying to quickly unwind Fannie Mae and Freddie Mac, which were seized by the government at the height of the financial crisis and now back the bulk of the mortgage market. But the administration has cautioned against removing the government’s support before the housing sector starts to stabilize.

Copyright 2011 Thomson Reuters

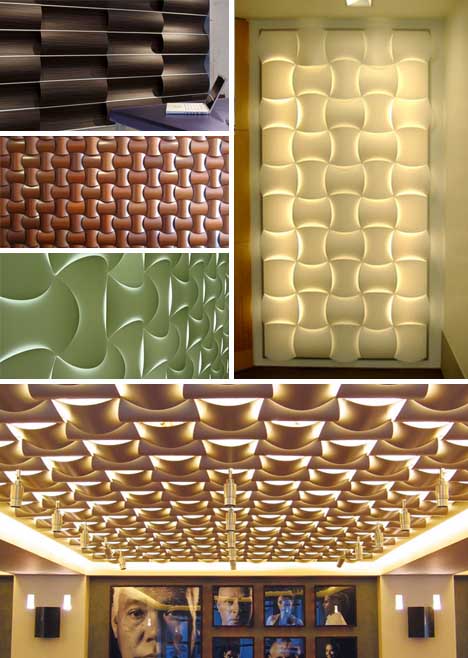

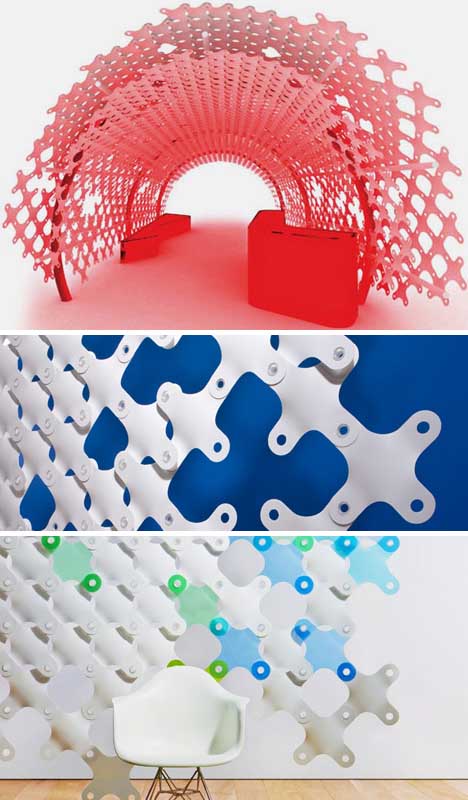

3D Space Dividers via 3 DIY Modular Partition Wall Systems

Structural walls aside, shaping space should be left to occupants – and that is the theory behind these dynamic and decorative modules that can be quickly and easily assembled, disassembled and reassembled by anyone.

Each set of pieces lends itself to particular spaces and spatial relationships – some let through light but block views, while others are intentionally permeable. Some would work well for sectioning off a home office or other space requiring privacy and professionalism.

Some are made for free-standing functions while others are essentially panelized finishes for covering an existing surface. 3-Form prefers not to prescribe (or proscribe) any particular purposes, but rather leaves it up to the user to put the puzzle together in a way that makes sense for specific needs and environmental conditions.

Millions of homeowners opting to remodel over buying a new home

Remodeling at an all time high

According to BuildFax’s August Remodeling Index, remodeling activity hit an all time high (since recording began in 2004) and based on permit data, rising nearly ten percent in the last year. Over 3.3 million residential remodeling projects are on track to be permitted in 2011, up from 3.1 million in 2010. Remodeling activity has risen every month for nearly the last two years straight.

“As mortgage rates hit record lows, it is apparent that millions of Americans are refinancing their homes and using some of their new monthly savings to reinvest in their homes with remodeling projects,” said Joe Emison, Vice President of Research and Development at BuildFax. “With remodeling activity growing at an estimated 9.5 percent in 2011 compared to 2010, this is one segment of the economy that is showing continued strength, even as other sectors struggle.”

Regional trends

Regional trends

According to National Mortgage Professional, BuildFax’s Index “is the only source directly reporting residential remodeling activity across the nation with monthly information derived through related building permit activity filed with local building departments across the country. This monthly report provides month-over-month and year-over-year comparisons on trends in remodeling activity for the entire United States, as well as for the four major regions of the country: Northeast, south, midwest and west.”

The Index reveals that in August, the west region rose 33.6 percent, the midwest jumped 11 percent and the south rose 8.2 percent. Declines were seen in the northeast of 0.8 percent and in the northeast, dropping 3.9 percent and although the report doesn’t seem to track why regions are performing so differently, but with Hurricane Irene hitting the east coast and droughts in the south, the environment hasn’t been friendly in all areas to remodeling, as homeowners are performing repairs. The scene appears to be remodel-friendly, however, and with two years of increases, homeowners are making the choice to stay put for longer.

Inflation Is A Thing Of The Past?

click image for larger view

The October 2011 Consumer Price Index for Urban Consumers (CPI-U) released today puts the September year-over-year inflation rate at 3.87%, which is fractionally below the 3.96% average since the end of World War II.

For a comparison of headline inflation with core inflation, which is based on the CPI excluding food and energy, see this monthly feature.

For better understanding of how CPI is measured and how it impacts your household, see my Inside Look at CPI components.

For an even closer look at how the components are behaving, see this X-Ray View of the data for the past five months.

The Bureau of Labor Statistics (BLS) has compiled CPI data since 1913, and numbers are conveniently available from the FRED repository (here). My long-term inflation charts reach back to 1872 by adding Warren and Pearson’s price index for the earlier years. The spliced series is available at Yale Professor Robert Shiller’s website. This look further back into the past dramatically illustrates the extreme oscillation between inflation and deflation during the first 70 years of our timeline. Click here for additional perspectives on inflation and the shrinking value of the dollar.

click image for larger view

Keaton Music Typewriter

File this under archaic devices I had no idea existed. Here’s a once in a lifetime opportunity to own a mint-condition Keaton Music Typewriter. Patented in the early 1930s, there are only a dozen or so in existence. What does it do? Exactly what you think it does. Via musicprintinghistory.org:

The Keaton Music Typewriter was first patented in 1936 (14 keys) by Robert H. Keaton from San Francisco, California. Another patent was taken out in 1953 (33 keys) which included improvements to the machine. The machine types on a sheet of paper lying flat under the typing mechanism. There are several Keaton music typewriters thought to be in existence in museums and private collections. It was marketed in the 1950s and sold for around $225. The typewriter made it easier for publishers, educators, and other musicians to produce music copies in quantity. Composers, however, preferred to write the music out by hand.

Having taught music notation in University, I can confidently state, most would take Finale over this, any day!

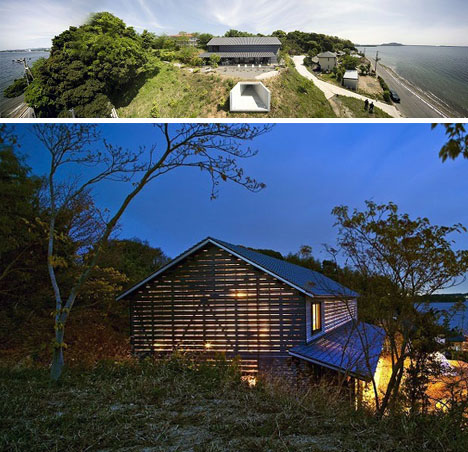

Underground Balcony?! Beautiful Barn Home with a Twist

There are plenty of lovely features to faun over in this domesticated version of a modern barn, but what stands out (both literally and otherwise) at first glance is a most unusual move that inverts the typical idea of a viewing platform.

By extending a concrete element out at basement level, residents are able to experience a combination of enclosed privacy and focused views over the water next to which the property sits.

Back to the main building, though: Yukiharu Suzuki & Associates styled the essential structure after the traditional form of a barn, with subtle tweaks to make it homey while returning a larger look and industrial-plus-agricultural aesthetic.

Spacing between slats allows in limited direct and indirect daylight on all sides, depending upon sun angle and time of day, while traditional mobile Japanese screens can subdivide spaces on demand.

Rental Market Emerges as Housing’s Bright Spot

“With rental demand rising and apartment economics improving, the multifamily sector is a positive signal for the U.S. housing industry,” writes Frank Nothaft, Freddie Mac’s Chief Economist, in the October 2011 U.S. Economic and Housing Market Outlook.

“With rental demand rising and apartment economics improving, the multifamily sector is a positive signal for the U.S. housing industry,” writes Frank Nothaft, Freddie Mac’s Chief Economist, in the October 2011 U.S. Economic and Housing Market Outlook.

An increase of 1.4 million households moved into rental housing in the year ending June 2011–a 4 percent rise in the number of tenant households in one year alone, the Census Bureau reports. Meanwhile, the home ownership rate dropped about 1.5 percent over the past year.

“While home sales remain sluggish despite the most affordable purchase market in decades, households have turned to rental to meet their shelter needs,” Nothaft writes in the report.

The increase in rental demand is due partially to some households who may have faced a short sale or foreclosure of a home they owned, Nothaft notes. However, he says most of the rental demand is coming from young and newly formed households, who are postponing home ownership. The home ownership rate for household heads under 30 years of age has fallen the sharpest in recent years.

As demand increases, vacancy rates are dropping and rents are rising. New construction for larger apartment buildings is also increasing, as property sales rise. Dollar-sales volume of apartment buildings was at its highest point in the second quarter since 2007, according to Real Capital Analytics. New construction starts of apartment buildings with at least 20 dwellings is also on the rise, posting its highest level since the end of 2008 in the second quarter too.