source: KCM

Archives for October 2012

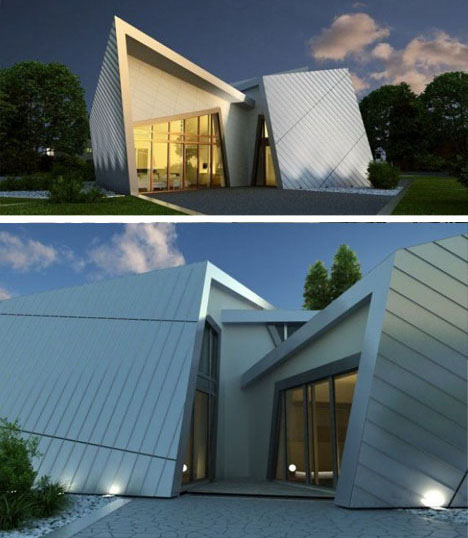

Pricey Prefab: Daniel Libeskind Does High-End Residential

Prefabrication can carry something of a stigma, being used to mass-produce cheap cookie-cutter structures. One famous architect has a new project, however, that shows another side to this manufacturing method.

Prefabrication can carry something of a stigma, being used to mass-produce cheap cookie-cutter structures. One famous architect has a new project, however, that shows another side to this manufacturing method.

The Libeskind Villa comes with a hefty two-million-pound price tag, but all of those compellingly complex angles that fans of Studio Daniel Libeskind have come to expect from his institutional architecture.

Only thirty lucky (and wealthy) patrons will be able to procure themselves a copy, raising one interesting question: can architecture work like artist prints or ceramics (instead of, say, a single painting or sculpture) and be sold in limited but still plural lots?

From the architect: “The Libeskind Villa is a 2 floor (with full basement), 4 bedroom, 5,000-square-foot signature series home that can be constructed anywhere in the world. The Villa creates a new dialogue between contemporary living and a completely new experience of space. Built from premium wood and zinc, this German-made, sculptural living space meets the highest standards of design, craftsmanship and sustainability. In addition to the design standards, it meets compliance with some of the toughest energy-saving standards worldwide.”

Housing Numbers from NAR’s Existing Home Sale Report

The National Association of Realtors’ (NAR) September Existing Home Sales Report revealed that sales declined modestly, but inventory continued to tighten and the national median home price recorded its seventh back-to-back monthly increase from a year earlier.

The National Association of Realtors’ (NAR) September Existing Home Sales Report revealed that sales declined modestly, but inventory continued to tighten and the national median home price recorded its seventh back-to-back monthly increase from a year earlier.

Total existing-home sales fell 1.7% but are 11% above the pace in September 2011.

Other findings revealed in the report:

-

Existing-home price: the national median was $183,900 in September, up 11.3 percent from a year ago.

-

Distressed homes – foreclosures and short sales accounted for 24 percent of September sales (13 percent were foreclosures and 11 percent were short sales), up from 22 percent in August and down from 30 percent in September 2011.

-

Foreclosures sold for an average discount of 21 percent below market value in August.

-

Short sales were discounted 13 percent below market value in August.

-

Housing inventory at the end September fell 3.3 percent which represents a 5.9-month supply at the current sales pace, down from a 6.0-month supply in August. Listed inventory is 20.0 percent below a year ago when there was an 8.1-month supply.

-

Time on market: the median was 70 days in September, unchanged from August, but down 30.7% from 101 days in September 2011.

-

First-time buyers accounted for 32 percent of purchasers in September, compared with 31 percent in August; they were 32 percent in September 2011.

-

All-cash sales were at 28 percent of transactions in September, up from 27 percent in August; they were 30 percent in September 2011.

-

Investors, who account for most cash sales, purchased 18 percent of homes in September, unchanged from August; they were 19 percent in September 2011.

Single Family Homes and Condominiums and Co-ops

Existing Single-family home sales declined 1.9 percent to a seasonally adjusted annual rate of 4.21 million in September from 4.29 million in August, but are 10.8 percent higher than the 3.80 million-unit level in September 2011. The median existing single-family home price was $184,300 in September, up 11.4 percent from a year ago.

Existing condominium and co-op sales were unchanged at a seasonally adjusted annual rate of 540,000 in September, but are 12.5 percent above the 480,000-unit pace a year ago. The median existing condo price was $181,000 in September, which is 10.0 percent higher than September 2011.

Regional Numbers

Northeast: Existing-home sales fell 6.3 percent to an annual level of 590,000 in September but are 7.3 percent above September 2011. The median price in the Northeast was $238,700, up 4.1 percent from a year ago.

Midwest: Existing-home sales slipped 0.9 percent in September to a pace of 1.10 million but are 19.6 percent higher than a year ago. The median price in the Midwest was $145,200, up 7.0 percent from September 2011.

South: Existing-home sales increased 0.5 percent to an annual level of 1.93 million in September and are 14.2 percent above September 2011. The median price in the region was $163,600, up 13.1 percent from a year ago.

West: Existing-home sales fell 3.4 percent to an annual pace of 1.13 million in September but are 0.9 percent above a year ago. With continuing inventory shortages in the region, the median price in the West was $246,300, which is 18.4 percent higher than September 2011.

Lawrence Yun, NAR chief economist, commented:

“Despite occasional month-to-month setbacks, we’re experiencing a genuine recovery. More people are attempting to buy homes than are able to qualify for mortgages, and recent price increases are not deterring buyer interest. Rather, inventory shortages are limiting sales, notably in parts of the West.”

Do You Really Know How to Rake Leaves? [video]

If you live in a place that actually experiences autumn (not you Southern California) then you’re probably seeing some foliage covering your lawn a little bit at a time. Before you know it, your grass is invisible as the fall season become a literal reality.

If you live in a place that actually experiences autumn (not you Southern California) then you’re probably seeing some foliage covering your lawn a little bit at a time. Before you know it, your grass is invisible as the fall season become a literal reality.

Soon you will head to your garage on a brisk Saturday with the dreaded task of having to rake your yard. My method of raking was to do it as fast as humanly possible to move on to more enjoyable things. I would make mini piles throughout the yard or, more likely, find someone I could pay on the cheap to do it for me. For those of you that are planning on raking your own lawn this autumn, chances are you’re doing it wrong.

Yes, I’m serious. Everything you’ve learned about raking leaves…ok, maybe not everything, but much of what I learned about raking leaves was just so I could get the job done without really thinking about what sacrifices my lawn was paying in the process.

I recently came across this video from eHow on how to rake leaves. Who knew I wasn’t doing it correctly? My posture was all off these past years. I was doing it too quickly and then I wondered in the spring why my lawn wasn’t lush and green like I had hoped.

Check out this quick video on how to rake your lawn and I guarantee you’ll learn something to help with the upcoming leafy chores of October and November.

The Beatles: Love Me Do single (50th Release Anniversary)

Falling Foreclosures Pushing Up Home Prices

As foreclosure backlogs have decreased, so have many of the big discounts on home prices. The slowdown in foreclosures is partially behind the recent rise in home prices, some economists say.

As foreclosure backlogs have decreased, so have many of the big discounts on home prices. The slowdown in foreclosures is partially behind the recent rise in home prices, some economists say.

“Deeply discounted existing homes have been subject to strong demand from cash buyers and investors looking to lock into housing’s attractive income returns,” says Paul Diggle, a housing economist at Capital Economics. “The supply of such homes, meanwhile, has been dwindling. That has bid up existing house prices, particularly at the lower end of the price spectrum."

The median price of existing homes nationwide was 9.5 higher in August compared to a year ago, and new home prices were up 17 percent in that same time period.

Distressed properties typically sell for big discounts. For example, in 2007 during a nationwide foreclosure surge, foreclosures tended to sell for about a third of the median price of the home. The housing markets with some of the largest price falls tended to have the highest number of distressed home sales.

Lately, foreclosures have been posting big drops. Last month, new foreclosure filings reached a five-year low, according to RealtyTrac, a real estate research firm that tracks foreclosure housing data.

“There is a shortage of inventory — as crazy as it sounds to say that,” says Daren Blomquist, a RealtyTrac spokesman. “In a lot of market there’s less inventory of foreclosed properties than there is demand. You’re hearing about multiple bids for these properties.”

Source: “Foreclosure Slowdown Pushing Home Prices Higher,” NBC News

![A History of Social Media [Infographic] image of copyblogger infographic thumbnail](http://netdna.copyblogger.com/images/history_of_social_media_thumb.jpg)