Archives for May 2012

Mother’s Day vs. Father’s Day [infographic]

70 Percent of Affluent Homeowners Looking to DIY Projects to Save Money

According to the Summer 2012 Merrill Edge Report, many mass affluent Americans are willing to make short-term sacrifices in order to get their finances in better shape. The report, released on April 26 by Bank of America, explores the financial concerns and priorities of mass affluent consumers, Americans with $50,000-$250,000 in investable assets.

This group, which consists of approximately 28 million households in the United States, has also shown over the last six months a rising concern over a number of financial issues, such as the cost of healthcare and being able to afford the lifestyle they want in retirement.

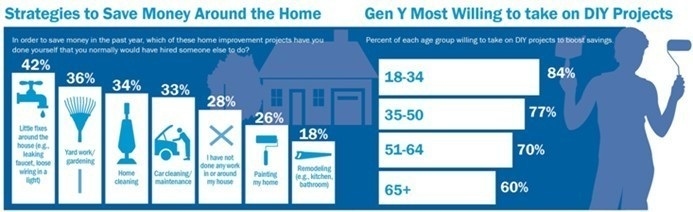

According to the findings, 70 percent of mass affluent Americans say they took on home improvement projects in the last year, such as plumbing, painting, and home cleaning, that they would normally hire someone else to do.

According to the findings, 70 percent of mass affluent Americans say they took on home improvement projects in the last year, such as plumbing, painting, and home cleaning, that they would normally hire someone else to do.

Younger members of the mass affluent segment were more likely to embark on these home improvement projects than their older counterparts.

84 percent of 18-34 year olds took on a project compared to 77 percent of 35-50 year olds and 60 percent of those aged 65 and older.

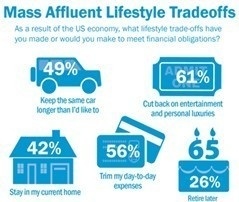

Other methods this group will utilize in order to meet financial obligations include cutting back on entertainment and personal luxuries (61 percent), trimming day-to-day expenses (56 percent), and keeping the same car longer than they’d like to (49 percent).

Other methods this group will utilize in order to meet financial obligations include cutting back on entertainment and personal luxuries (61 percent), trimming day-to-day expenses (56 percent), and keeping the same car longer than they’d like to (49 percent).

Source: Bank of America

Musical Notes Spring to Life to Create Art

The work by artist Erika Iris Simmons is a collection of faces and figures that grow out of recycled materials, reconfigured musical notes, and the negative space that results from these shapes. Simmons started out as a face-painter at Universal Studios and then went on to study makeup design. She says, “I became fascinated with books about perception and cognition. I think creating these optical illusions everyday [with makeup] made me curious about how our minds perceive shadows, and how we put together the image of the world around us.”

The work by artist Erika Iris Simmons is a collection of faces and figures that grow out of recycled materials, reconfigured musical notes, and the negative space that results from these shapes. Simmons started out as a face-painter at Universal Studios and then went on to study makeup design. She says, “I became fascinated with books about perception and cognition. I think creating these optical illusions everyday [with makeup] made me curious about how our minds perceive shadows, and how we put together the image of the world around us.”

For these pieces that she calls Paperworks, Simmons meticulously cuts out musical notes and pastes them back together in stunning portraits, patterns, and shapes in her attempt to, “visualize the transcendence felt in beautiful music.” I absolutely love how the sheet music comes alive as the figures move, sway, and rise off the pages.

Erika Iris Simmons’s website

Short Sales: The Mortgage Originators Role in the Process

A key component to the success of a short sale involves working with a Mortgage Originator who is well versed in the short sale process. The short sale negotiation process is a patience testing task. The complications are many, however if the buyer is securing mortgage financing and is working with an originator that understands that short sale process the buyer and seller can be rest assured, in most circumstances, that the transaction will get to the closing table.

A key component to the success of a short sale involves working with a Mortgage Originator who is well versed in the short sale process. The short sale negotiation process is a patience testing task. The complications are many, however if the buyer is securing mortgage financing and is working with an originator that understands that short sale process the buyer and seller can be rest assured, in most circumstances, that the transaction will get to the closing table.

There are 5 key questions to ask when choosing a Mortgage Originator for the purchase of a short sale transaction.

1.) Are they versed in the Anatomy of the Short Sale process?

The proper mortgage origination process pertaining to a short sale purchase is a bit different than a normal non-distressed property purchase. However, it is always my belief that in order to lead the cavalry one must have sat in the saddle. Putting this in terms of the short sale process, in order to originate a loan for a buyer who is interested in a short sale, one must understand the entire anatomy of the short sale process. This includes the challenges that the sellers faces regarding financial difficulty and hardship, the challenges that the selling agents face regarding listing and negotiating the short payoff and most importantly the strict timelines that come along with a short sale transaction.

2.) Will they issue a “TRUE” pre-approval prior to Short Sale approval?

A complete short sale package should include a mortgage pre-approval for the buyer if the buyer is securing mortgage financing to purchase the property. The originator should have taken a full mortgage application, documented income, assets, reviewed the buyers credit and submitted the file through the appropriate automated underwriting service (ex DU,LP) prior to issuing a pre-approval letter to the buyer.

The pre-approval process for a short sale transaction should not be any different than the pre-approval process in a non-distressed sale. Having said this, we have closed over 2500 short sale transactions nationwide. Many times, because of the long timeframes that are involved in a short sale, originators are not properly pre-qualifying the buyer prior to short sale approval. Originators are waiting until the short sale is approved by the short selling bank to submit the client profile to underwriting and is some cases to even issue a complete pre-approval. That is too late! In every circumstance the pre-approval process should be done thoroughly before the short sale approval.

3.) Will they order the appraisal prior to Short Sale approval?

In a non-distressed sale typically, once the purchase contract is signed, the Mortgage Originator or their processing team will then order the appraisal for the property so that it may be reviewed by underwriting. Underwriting will then make sure the property is acceptable as collateral based upon the loan that is being applied for.

This process should hold true if the buyer is buying a short sale. Many times however, the appraisal is not ordered until the short sale is approved by the short selling bank. Often, this will delay the closing timeframes. Also, consider this, if the short selling bank based upon their appraisal, counters they buyer with a higher price, the buyer who has already had their appraisal done will have the ability to issue a rebuttal based on their appraisal. The Buyer’s/Lender’s appraisal is a great tool to negotiate value disputes with short selling banks.

4.) Will they communicate with the Short Sale Negotiator?

There is one line of communication that is a must during a short sale. This is the communication between the Short Sale Negotiator and the Mortgage Originator. The Mortgage Originator should be in touch with the negotiator on a weekly or bi weekly basis to obtain the status of the negotiation. It is imperative that the originator be informed of such deadlines as closing dates, approval expirations, BPO time lines, contract changes etc.

5.) Will they keep the Buyer engaged throughout the process?

In a non-distressed sale the timelines are usually short from pre-approval to closing. The potential buyer will obtain a pre-approval for mortgage financing; they will shop for a home, make an offer and then close on the property. Most cases this process takes between 30-60 days.

In contrast, the short sale purchase timeline could take the normal 30 to 45 days of shopping but, from the time a buyer puts an offer on a property to the time they actually close could take 90-120 days. During this time frame, the mortgage originator must keep the buyer engaged. The information gathered in the pre-approval process meaning paystubs, bank statements etc. will need to be updated appropriately so that when the short sale bank issues their approval the buyer is ready to close on time and within the approval guidelines. All too often short sale negotiators are asked to obtain short sale approval extensions from the short selling bank because the buyer could not close on time. Most of this stems from the Mortgage Originator scrambling to obtain last minute documentation that could have been avoided if the buyer’s credit file was routinely updated throughout the entire short sale process.

In closing, with the abundance of short sale transactions permeating the marketplace, it is imperative that all interested parties to a short sale work with a Mortgage Professional that understands this segment of the marketplace. By keeping the 5 questions above in mind, you may alleviate the possibility of a short sale transaction failing because of buyer financing falling apart.

(via)

10 housing markets set for double-digit price gains

NEW YORK (CNNMoney) — Ten hard-hit housing markets will record double-digit price increases through 2013, according to a report Wednesday.

And with mortgage rates low, many house hunters have already started to pounce on bargains, said David Stiff, chief economist at Fiserv, a financial analytics company that prepared the forecast.

"Some markets may have overshot to the downside, and people are jumping in to try to catch the bottom," Stiff said.

Nationwide, home prices will start rebounding late this year and gain an average of 4% a year over the next five years, Fiserv projects.

In a separate report released Wednesday by the National Association of Realtors, the national median home price declined by just 0.4% in the three months ended March 31 compared with the same period in 2011.

About half of the 146 metro-area markets surveyed by NAR showed a price increase, as buyers make inroads into the supply of homes for sale all across the country. National inventory has dropped by 22% compared to a year earlier.

"Given the steadily dwindling supply of inventory and notably higher listing prices that are being negotiated today, prices are expected to show further improvements in the near future," said Lawrence Yun, NAR’s chief economist.

Home prices will also be driven higher as banks opt for short sales instead of repossessions. Repossessed homes sell for between 25% and 50% less than comparable homes sold by conventional sellers, according to Daren Blomquist, a spokesman for RealtyTrac, which markets foreclosed properties.

Bank repossessions often go through lengthy foreclosure processes and long periods of vacancy, during which they may deteriorate and lose value.

Mortgage payments at lowest level in decades

Fiserv’s Stiff forecasts that Madera, Calif., will produce the largest home price gain over the next two years. This market bubbled during the housing boom, with the median home price jumping above $300,000, according to the National Association of Home Builders.

Prices have since tumbled 53% off their peak, to about $125,000. Fiserv is projecting a price jump of 21.5% by the end of 2013 with 16.5% of that increase coming next year.

Other double-digit gainers will include Medford, Ore., with a 20.1% rise, Yuma, Ariz., with 16.7%, and Corvallis, Ore., with 11.4%.

20 reasons to switch to Google+ [infographic]

Google’s answer to Facebook recently announced 100 million users. While that’s still nowhere near Facebook’s 800 million, it clearly has a lot to offer its users- especially those who use other Google services. The jury on Google+ remains out, but in this infographic we came up with twenty reasons to switch to it.

(via)

Short Sale vs. Foreclosure – 10 Common Myths Busted

It’s likely you’ve heard the term “short sale” thrown around quite a bit. But what, exactly, is a short sale?

It’s likely you’ve heard the term “short sale” thrown around quite a bit. But what, exactly, is a short sale?

A short sale is when a bank agrees to accept less than the total amount owed on a mortgage to avoid having to foreclose on the property. This is not a new practice; banks have been doing short sales for years. Only recently, due to the current state of the housing market and economy, has this process become a part of the public consciousness.

To be eligible for a short sale you first have to qualify!

To qualify for a short sale:

- Your house must be worth less than you owe on it.

- You must be able to prove that you are the victim of a true financial hardship, such as a decrease in wages, job loss, or medical condition that has altered your ability to make the same income as when the loan was originated. Divorce, estate situations, etc.… also qualify.

Now that you have a basic understanding of what a short sale is, there are some huge misconceptions when it comes to a short sale vs. a foreclosure. We take the most common myths surrounding both short sales and foreclosures and give a brief explanation. LET’S BUST SOME MYTHS!!

1.) If you let your home go to foreclosure you are done with the situation and you can walk away with a clean slate. The reality is that this couldn’t be any farther from the truth in most situations. You could end up with an IRS tax liability and still owing the bank money. Let me explain. Please keep in mind that if your property does go into foreclosure you may be liable for the difference of what is owed on the property versus what is sells for at auction, in the form of a deficiency balance! Please note this is state specific and in most states you will be liable for the shortfall, but in some states the bank may not always be able to pursue the debt. Check your state law as it varies widely from state to state.

Here is an example of how a deficiency balance works

If you owe $200,000 on the property and it sells at auction for $150,000, you could be liable for the $50,000 difference if your state law allows it.

Not only could you be liable for the difference to the bank, but in some situations you could also be liable to the IRS! Although there are exemptions (mostly for principle residences) under the Mortgage Debt Forgiveness Act, there are times when you could be taxed on both a short sale and a foreclosure, even in a principle residence situation. Since the tax code on this is a little complicated and I am not a CPA, I advise always talking to a CPA when in this situation as you are weighing your options. Hard to believe? Well, believe it or not, the IRS counts the difference between the sale and the charged off debt as a “gain” on your taxes. That’s right-you lost money and it’s counted as a gain! (I didn’t make that rule, that’s a wonderful brainchild of the IRS). Banks and the IRS can go as far as attaching your wages. Not to mention if you let your home go to foreclosure you will have that on your credit, as well.

Guess What? A short sale can alleviate your liability to the bank, in most situations. There are also exceptions to this, but in most cases banks are releasing homeowners from the deficiency balance on a short sale.

2.) There are no options to avoid foreclosure. Now more than ever, there are options to avoid foreclosure. Besides a short sale, loan modifications along with deed in lieu are also examples of the many options. In most cases (but not all) a short sale is the best option. Either way, there are more options today than there have ever been to avoid foreclosure.

3.) Banks do not want to participate in a short sale, or, it is too hard to qualify for a short sale. Banks would rather perform a short sale than a foreclosure any day. A foreclosure takes a long time and creates a huge expense for the banks; a short sale saves both time and money. Banks have more foreclosure inventory than ever before, and certainly do not want any more. Banks more than ever welcome short sales. Qualifying for a short sale is easier than you think, you need to have a true financial hardship, or a change in your finances and your house has to be worth less than what you owe on it. Not only do consumers, but banks also now have government incentive to participate in short sales.

4.) Short sales are not that common. At this present time, short sales range from 10-50 % of sales in various markets and it is predicted that in 2012 we will have more short sales than any other year, to date. Due to economic changes in the last few years, this is something that is affecting millions of Americans. Short sales are in every market, and are not just limited to any particular income class. This has affected everyone from all facets of life. A short sale should be looked at as a helpful tool, not a negative stigma. That is why the government is offering programs that actually pay consumers to participate in short sales. It is not just affecting one community; it is affecting communities and consumers across the nation.

5.) The short sale process is too difficult and they often get denied. Though the short sale process is time consuming; it is not as difficult as the media would have you believe. The problem is that most short sales are denied because of a misunderstanding of the process. It is true that if the short sale process is not followed correctly there is a good chance of getting denied. An experienced agent knows how to avoid this. Short sales require a lot of experience, and a special skill set. If you are looking to go the option of a short sale make sure your agent is skilled and experienced in this area.

6.) Short sales will cost me money out of pocket. A short sale should not cost you any out of pocket money. In fact, you could get between $3000-up to $30,000 to participate in a short sale. In many ways, a short sale may put you in a better financial position than prior to the short sale. Almost every short sale program now has some type of financial incentive for the home owner, as long as it is a principle residence, and we are even seeing relocation money being paid on some investment/second homes. As a seller of a property you should never have to pay for any short sale cost upfront to any professional service. Realtors charge a commission that is paid for by the bank. In most communities there are also non-profits and HUD counselors who can help you with foreclosure prevention options for free. The only potential cost you could incur is if the bank would not release you from a deficiency balance in the short sale, which is happening less and less now.

7.) If I am behind on my payments, I can perform a short sale any time. The farther you get behind on your payments, the harder it is to get a short sale approved. The closer a property gets to a foreclosure the harder it is to convince the bank to perform a short sale. As they get closer to a foreclosure sale more money is spent, thus deterring them from doing a short sale. If you think you need to perform a short sale, time is of the essence; the sooner you start the process, the better. Waiting too long can trigger the ramifications of a foreclosure, losing the ability to do a short sale as a viable option.

8.) I have already been sent a foreclosure notice so I can’t perform a short sale. For the most part just because you received a foreclosure notice or notice of default it does not mean that you do not have time to perform a short sale. The timeline and specifics do vary from state to state, but having done short sales all over the country, I have seen banks postpone a foreclosure to work a short sale option as close as 30 days prior to the scheduled foreclosure auction, but the longer you wait the less chance you have. If you have received a legal foreclosure notice, please reach out to a professional right away. The longer you wait, and the closer you get to foreclosure, the fewer options you have. If you have received a notice to foreclose this means the bank is filing paperwork and starting the process to take legal action to repossess the house. You still have time at this point to prevent foreclosure, but do not hesitate! The closer you get to the foreclosure date the harder it becomes to negotiate with the bank for whichever option you choose.

9.) I was denied for a loan modification, so I know I will get denied for a short sale. Short sales and loan modifications are handled by two separate departments at the bank. These processes are totally different in approval and denial. If you got denied for a modification you can still apply for a short sale; in some cases you can get a short sale approved faster than a loan modification, as some loan modifications are denied because they cannot reduce the loan low enough based on the consumers income.

10.) If I go through a short sale I cannot buy another house for a long time. The time to buy another house depends on your entire credit picture and can vary from 12-24 months. There are even a few FHA programs that allow for a purchase sooner than that. I have worked with clients who went through a short sale and bought another house in less than 12 months.

These are just a few of the common myths surrounding short sales and foreclosure. With the options available today, no homeowner should ever have to go through foreclosure, and hopefully this information can help a few more homeowners think twice before walking away from their home not realizing the possible long term ramifications a foreclosure can have.

(via)